nowadays, many peoples were interested in buying and selling of stocks of the companies, they firstly creates a demat account with the broker and buy the shares in dematerialised form. but in recent past times most of the peoples were used to buy the physical form of shares that is paper stock certificates. so today in this article you can get to know about what is a physical stock certificate? how to get a physical stock certificates? and some other aspects related to physical stock certificates.

what is stock certificate?

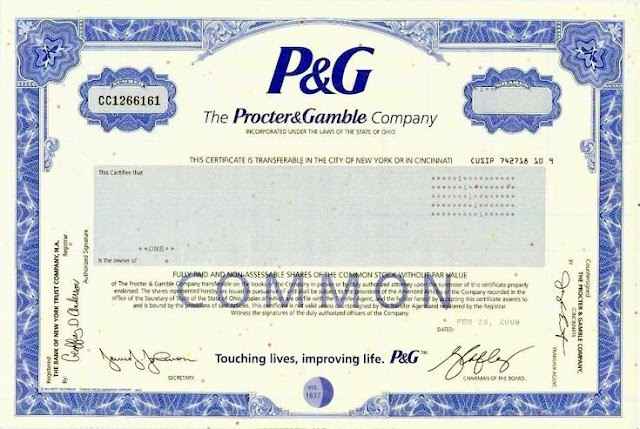

stock certificate or physical stocks is a piece of paper that declares the shareholding of a particular person in an organization.

it actually defines the ownership of a person in the company. in recent past times peoples used to buy the shares of company in physical form, these physical form of stock includes the total number of shares that an investor owns in the company, the date of purchasing of shares, the access and authorities of the shareholder if any in the organization. the voting and legal rights accessible to the shareholder, unique identification number of shareholders, etc.

these stock certificates were issued by the companies according to the norms and conditions, which becomes eligible after the companies legal seal or stamp and authorized signatory.

before introducing of dematerialised account physical stocks are the only way to buy and sell the shares of companies. so it becomes quite challenging to keep proper track record of the current owner and who will get the benefits of shares like dividends, bonus shares, etc. holding shares in physical form have some advantages and disadvantages.

the benefits of holding shares in physical form are long term holding capabilities, high amount investment options, stock certificate gifting, etc. here the long term holding capabilities means the limits in selling shares which allows the investor to hold his shares for longer period of time. the high amount investment option means usually when an investor tends to invest his money in any company he can go with a higher amount for even higher returns and authorities. the disadvantages of holding physical form of shares is lower direct interaction with the company, limitations on buying and selling of stocks, fear of loosing the stock certificates, etc.

after buying shares in the physical form the investor has lower direct contact with the company as he is not been able to visit company on daily basis and take the regular updates about the company's working and management.

limitations on buying and selling of shares is also a big disadvantage of physical stock holdings as some traders like intraday trader, swing traders, etc wants to buy and sell there shares on timely basis and according to the market fluctuations but due to lots of paperwork it was quite difficult to keep proper followup with the market. fear of loosing stock certificate is also a big problem for having stocks in physical form as maybe due to reasons like burnt, theft, etc.

how to get a physical stock certificates?

holding a physical paper stocks would be a hassle thing, many of the investors loss their money invested in a company due to loss of physical stock certificates. and it is very difficult to revive the money invested from the company it also affects the organization, for that reason most of the companies did not provide physical certificate of shares in current period.

but incase if someone wants to get a physical stock certificate then he have to contact with his brokerage firm or he can contact to the company's authorities directly.

before online brokers and personally directed accounts holding a physical stock certificate was a necessity, as this was the only way to authenticate stock ownership now this is not the case anymore although you may not need to hold the stock certificate you may really request one from the company or the brokerage firm can do that for you. now there are some additional expenses that are associated with getting that stock certificates and you have to pay for that, first to pay the commissions and then you have to pay the corporation to actually print the certificates.

who can issue physical stock certificate?

mostly c corporation and s corporation private limited companies can issue stock certificates. the other organizations have there own method to justify the ownership of a person in a company. so how an individual get his share certificate? the easiest way to get the share certificate is through the brokerage firm with whom the investor hold his demat account. the broker have the complete details regarding his demat account that is of total number of shareholdings, list of companies in which he occupy the shares, etc.

any people who have a demat account or purchased a share of a company then it shows the eligiblity to own a stock certificate. but nowadays due to digitalization most of the peoples used to open their account in digital form which abides them from lots of limitations and also helps them to keep proper record of their statement of accounts.

in this case issuance of stock certificate is not necessary as the depository participant that is cdsl or nsdl have complete records of the investors buying and selling transactions so everyone gets the updated account statement directly into their mail. so due to this essence and comfort many peoples deny to hold a paper stock certificate.

requirements for having a paper stock certificate.

- having a demat account.

- shares in demat account.

- commissions and charges.

- comply with norms and conditions, etc.

are stock certificates worth anything?

What are stock certificate used for?

- specification of ownership,

- gifting purpose,

- using as a collateral,

- putting for mortgage, etc.

.webp)

.jpg)

0 Comments